- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Adobe Produces Strong FCF - ADBE Stock Could Be Over 20% Too Cheap

/Adobe%20Inc%20logo%20on%20phone%20on%20desk-by%20Tattoboo%20via%20Shutterstock.jpg)

Adobe, Inc. (ADBE) produced strong free cash flow for its fiscal Q3 ending Aug. 29, but ADBE stock is down. Assuming it can generate 41% free cash flow (FCF) margins over the next year, ADBE stock could be over 20% too cheap. This article will show why.

ADBE is trading at $347.75 in midday trading on Monday, Sept. 15. This is below its pre-earnings peak price of $363.21 on Aug. 25 and well off its 6-month peak of $420.68 on May 19.

However, based on its trailing 12-month (TTM) FCF margin history, it's possible Adobe could be worth over 20.7% more at $417.30 per share. Let's see why.

Strong Revenue Growth

Adobe, the parent of the PDF document, produced strong +10.7% Q3 YoY revenue growth, mostly from subscriptions (i.e., 96.7% of sales). Similarly, its 9-month revenue numbers were up 10.54%.

Adobe is quite unique in that there is no bulge in its subscription renewals by quarter, as is often the case when other SaaS (software as a service) companies gain annual subscription renewals.

As a result, its QoQ revenue growth is important. For example, Adobe's revenue rose almost 2% over the last quarter (i.e., 1.958%). That compounds out to an annualized growth rate of over 8.06%.

But analysts now project that next year, annual revenue could reach $25.85 billion, or +9.16% higher than this year's expected $23.68 billion (for the years ending Nov. 30). In other words, subscription revenue is expected to accelerate its underlying growth rate.

Strong FCF and FCF Margins

This is also evident in Adobe's free cash flow (FCF) and FCF margins.

In fiscal Q3, its operating cash flow was $2.198 billion on $5.988 billion in quarterly revenue, an operating cash flow (OCF) margin of 36.7%. That is a very high margin that ensures the company will generate large amounts of free cash flow (FCF).

For example, after deducting $72 million in capex spending, its FCF works out to $2.126 billion, or 35.5% of revenue. That is close to last year's 36.3% FCF margin, according to Stock Analysis.

Moreover, over the trailing 12 months (TTM), Adobe has generated $9.599 billion in FCF, or 41.41% of revenue.

So, if Adobe can keep this up, its forecast FCF could exceed $10 billion.

For example, based on analysts' expected 2026 revenue of $25.85 billion, and assuming it makes at least a 41% FCF margin:

$25.85 billion FY 2026 revenue x 0.41 = $10.6 billion FCF

That could push ADBE stock higher. Here's why.

Target Price for ADBE Stock Using FCF Yield Metrics

Today, Adobe's market capitalization is $147.7 billion, according to Yahoo! Finance. That means its TTM FCF of $9.6 billion represents 6.50% of its market cap.

So, using our estimate of $10.34 billion, and assuming the market raises the valuation to a 6.0% FCF yield:

$10.6 b / 0.06 = $176.7 billion market cap

That is 19.6% higher than today's market cap. In other words, ADBE stock could be worth 20% more, or:

$347.75 x 1.2 = $417.30 per share target

Analysts are even more bullish. For example, Yahoo! Finance reports that the average price target of 40 analysts is $457.52. Similarly, AnaChart.com shows that 33 analysts have an average price target of $409.71.

That implies the analyst's average survey is $433.62, which is still higher than our target price of $417.30.

The bottom line is that ADBE stock could be too cheap here - well over 20% undervalued.

One way to play this is to sell short out-of-the-money (OTM) put options in nearby expiry periods. That way, an investor can set a lower buy-in price target and get paid while waiting.

Shorting OTM ADBE Puts

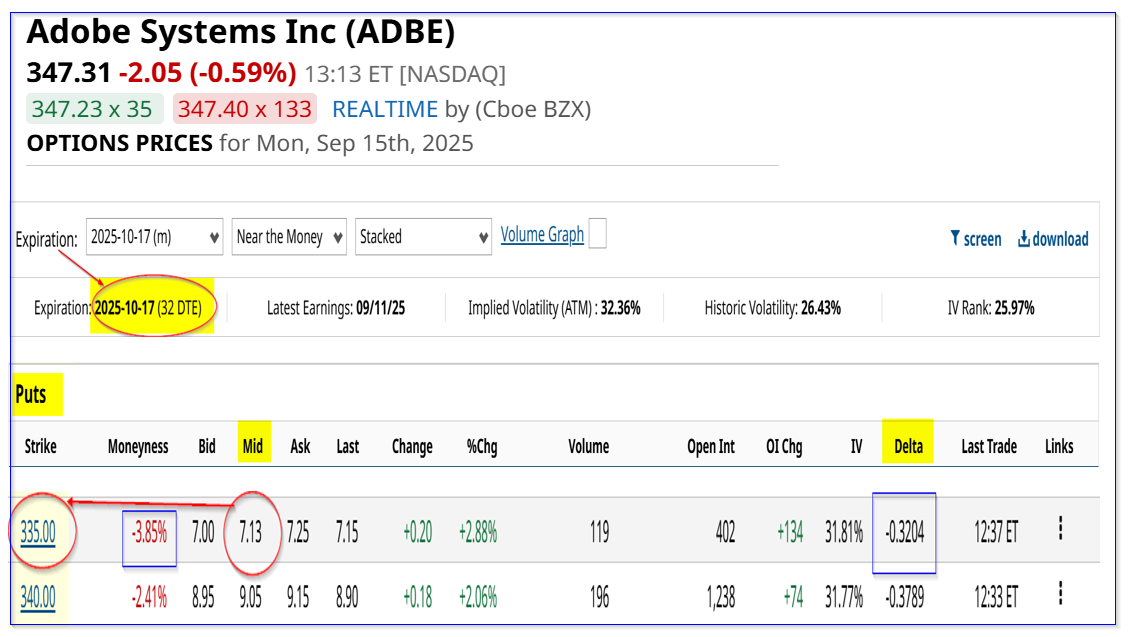

For example, look at the Oct. 17 expiry period, about one month from now. It shows that the $335.00 strike price put option contract has a midpoint premium of $7.13 per put.

That allows a short-seller of these puts to make an immediate yield of 2.12% (i.e., $7.13/$335.00) for a contract exercise price that is over 3.8% below today's trading price.

That means the breakeven point, if ADBE falls to $335.00, is $327.87, or 5.75% below today's price.

Moreover, if the investor can repeat this trade every month for 3 months, the expected return (ER) is +6.36%. That is the same as if ADBE rises to $369.98 over the next 3 months.

The bottom line is that an investor can take advantage of this lower ADBE price by shorting OTM puts. Existing investors in ADBE can potentially lower their average cost this way. New investors can set a lower buy-in target price, in case ADBE keeps falling.

Just keep in mind that this could also lead to a potential unrealized capital loss. That would happen if ADBE falls below the breakeven point.

Investors should study the risks associated with shorting OTM puts. One way to do this is to review Barchart's Options Learn Center webinars.

Nevertheless, at least with shorting OTM puts, the investor's only downside is having to buy shares at a lower price. Given the potential upside in ADBE stock, this could lead to over a 20% upside, based on our target price calculation above.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.